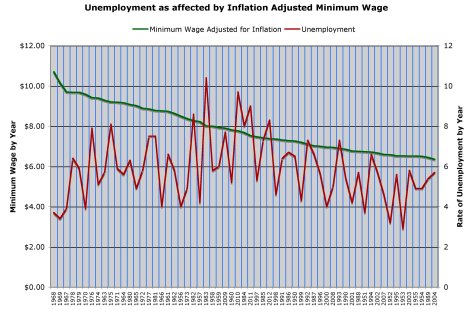

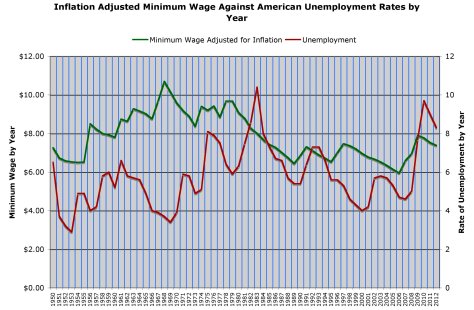

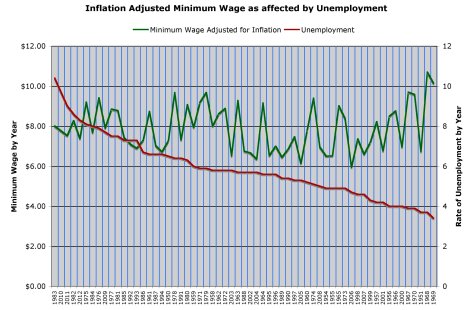

Between 1950 and 2012 America’s unemployment rate has been between a low of 2.9% in 1953 and a high of 10.4% in 1983, with a median of 5.7%. The Federal minimum wage, adjusted for inflation (2013 dollars), has ranged from a low of $5.95 in 2006 to a high of $10.70 in 1968, with a median of $7.47. The government has increased the minimum wage 14 times between 1950 and 2012. According to many right-wing, capitalist voices, such as radio journalist Lars Larson, every time we raise the minimum wage, unemployment rates will rise and businesses will fail as a result. Is it true?

The quick answer is no, but that is not necessarily a justification to raise the minimum wage beyond small adjustments for inflation.

Between 1950 and 2013 the government raised the minimum wage 14 times. Unemployment rates actually fell 8 out of 14 times.

Originally, our government enacted a minimum wage standard to stop wealthy industrialists from raping the American worker. Today the purpose of a minimum wage is to provide a young kid with no skills, or a disabled worker, a base wage that gives them a sliver of human dignity. It is a place to start, not a long-term survival strategy.

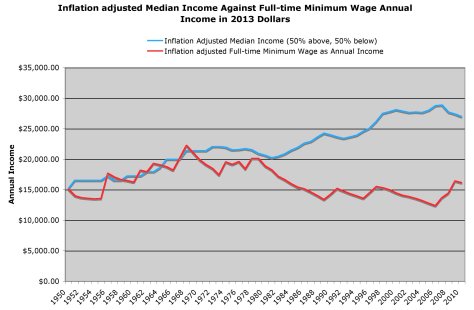

Adjusted for inflation, the minimum wage today is about the same as it was in 1950, the buying power of about $7.25/hour. Between 1950 and 1969 America’s full time, minimum wage was about 95% of the median wage. That means, for those two decades, almost 50% of jobs in America were essentially minimum wage jobs.

While it does not reflect increases in worker productivity, and has not kept pace with the raises the top 1% have afforded themselves, since 1980 the gap between minimum and median wage has steadily grown.

Today’s median American income is the same as a full-time, $13.00/hour job. That is $3.50/hour better than the nation’s highest minimum wage, Washington D.C.’s rate of $9.50/hour. Only 4.3% of American workers are paid the federal minimum. Once you factor in the cost of non-wage compensation, things like employer subsidized health insurance, today’s yearly wages and benefits are significantly better for 96% of Americans than in 1950. That is why America’s “poor” can usually afford lattes, smart-phones, high-speed internet, Xbox and Netflix, in addition to the traditional beer and cigarettes.

While wages certainly have not increased at the same rate as worker productivity, and the wealth gap between the top 1% and the rest of us has become vast chasm fueled by extreme greed, no one can rationally say that America’s working poor, as a group, are not better off today than 30 or 60 years ago. All that time, the minimum wage, adjusted for inflation, has essentially been flat.

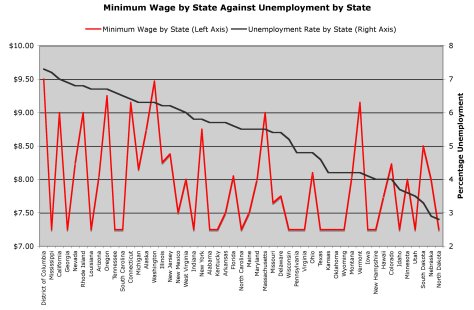

Plenty of states with high minimum wages have low unemployment while plenty of states who use the federal minimum wage have high unemployment.

In today’s America, most minimum wage jobs are found in small, Mom & Pop operations run by your next-door neighbor, like restaurants, landscaping services, small retailers, family farms and the like. These businesses often run on very thin profit margins, and their owners are rarely fabulously wealthy. These are the businesses most affected by increases in the minimum wage. They can handle inflationary increases, but if you think a small, independent business can suddenly absorb the difference between $8.00/hour and $15.00/hour, think again. Unfortunately, when they go out of business, they hardly make a statistical ripple in the economy. While their existence is important to the spirit of America, they do not mean spit to our GDP.

Years with low unemployment rates have the same affective minimum wages as year with high unemployment.

And that is why raising the minimum wage does not now, nor has it in the past had a statistically significant impact on unemployment and business failures in America. No one in their right mind can pin any economic bust on the wages of the least among us. It is the captains of industry and banking, along with political spendthrifts, who are responsible for all our busts, not some kid stocking shelves at the local market.